Resources

PCI DSS 4.0 Use Case

Driving security from PCI DSS 4.0 compliance

Harnessing the power of Nipper Resilience to keep payments data safe - and secure the attack surface, beyond the CDE

What is PCI DSS?

PCI DSS (Payment Card Industry Data Security Standard) is a set of requirements designed to ensure all businesses, regardless of size, that handle credit card information maintain a secure environment.

Protecting cardholder data

ISAs and QSAs use Nipper on-demand, to assess - with the precision, accuracy and know how of a pentester - whether Cardholder Data Environments (CDE) are being adequately protected by correctly configured firewalls, switches and routers, through automated checks that determine the:

- Firewalls’ ability to protect the CDE at the perimeter

- Routers’ ability to maintain effective network segmentation

- Switches’ ability to prevent unauthorized access to the CDE and ensure the integrity of network communications

Keeping the CDE secure and segmented from other parts of your network is the ultimate mitigating control when it comes to protecting cardholder data. Hardening networks from the inside-out to prevent unauthorized CDE access, instantly reduces the attack surface, and the network infrastructure that needs to comply with PCI DSS.

Assessing PCI DSS compliance with Nipper solutions

In Nipper v3.0 and later, relevant device checks have been automatically mapped to PCI DSS 4.0 requirements, and the results are prioritized by compliance risk. Providing evidence-based findings for both passed and failed network checks, as well as any results that require further investigation, enables Nipper to support even greater time savings when needing to demonstrate compliance. For each device tested, findings are listed against applicable PCI DSS requirements, with an explanation of the testing procedure to validate the device’s compliance posture.

For non-compliances, Nipper identifies the specific devices affected and provides a risk analysis which determines the ease of exploitation and potential impact to security if exploited. Combined with an ease of fix rating, and command line fix instructions (where possible), Nipper determines the priority for remediation to reduce the mean time to remediate (MTTR) and support compliance posture improvement.

To fully adhere to PCI DSS 4.0, ISAs now also need to regularly assess network infrastructure, and where automation allows, assess all devices, rather than a sample. What was secure yesterday at the point of audit may no longer be secure today. Using Nipper helps to reduce the assessment of each device by up to 80%, but for compliance teams that frequently need to assess large and/or multiple CDEs, a more scalable solution is required.

Introducing Nipper Resilience

Nipper Resilience in action

Keeping the CDE secure and segmented from other parts of your network is the ultimate mitigating control when it comes to protecting cardholder data. Hardening from the inside-out to prevent unauthorized CDE access instantly reduces the attack surface, and the network infrastructure that needs to comply with PCI DSS.

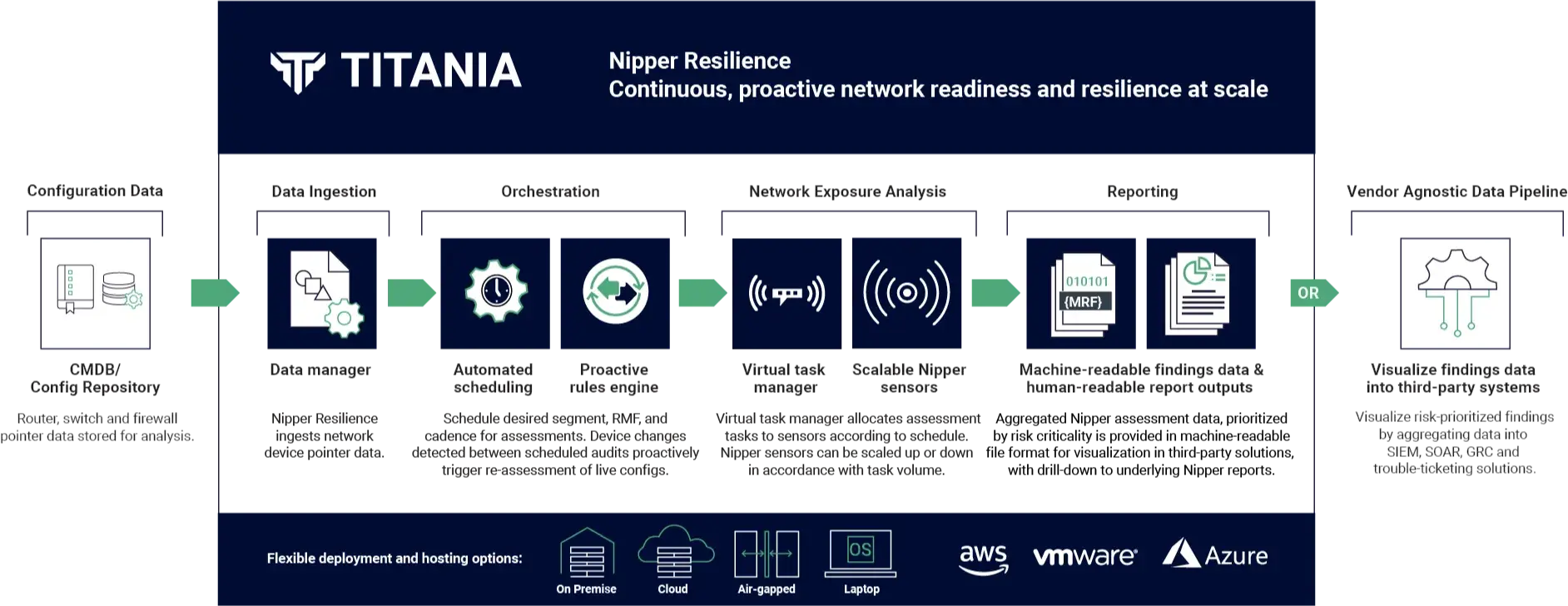

Nipper Resilience enables SOC and NOC teams to achieve this on a continuous basis without affecting operational bandwidth of the network, by passively synching to multiple CMDBs and configuration repositories:

- Sync up to CMDBs containing hundreds of thousands of device configurations in as little as 10 mins

- Utilize segment data and taxonomy from the CMDB

- Schedule a PCI DSS assessment of your entire CDE network infrastructure in three easy steps.

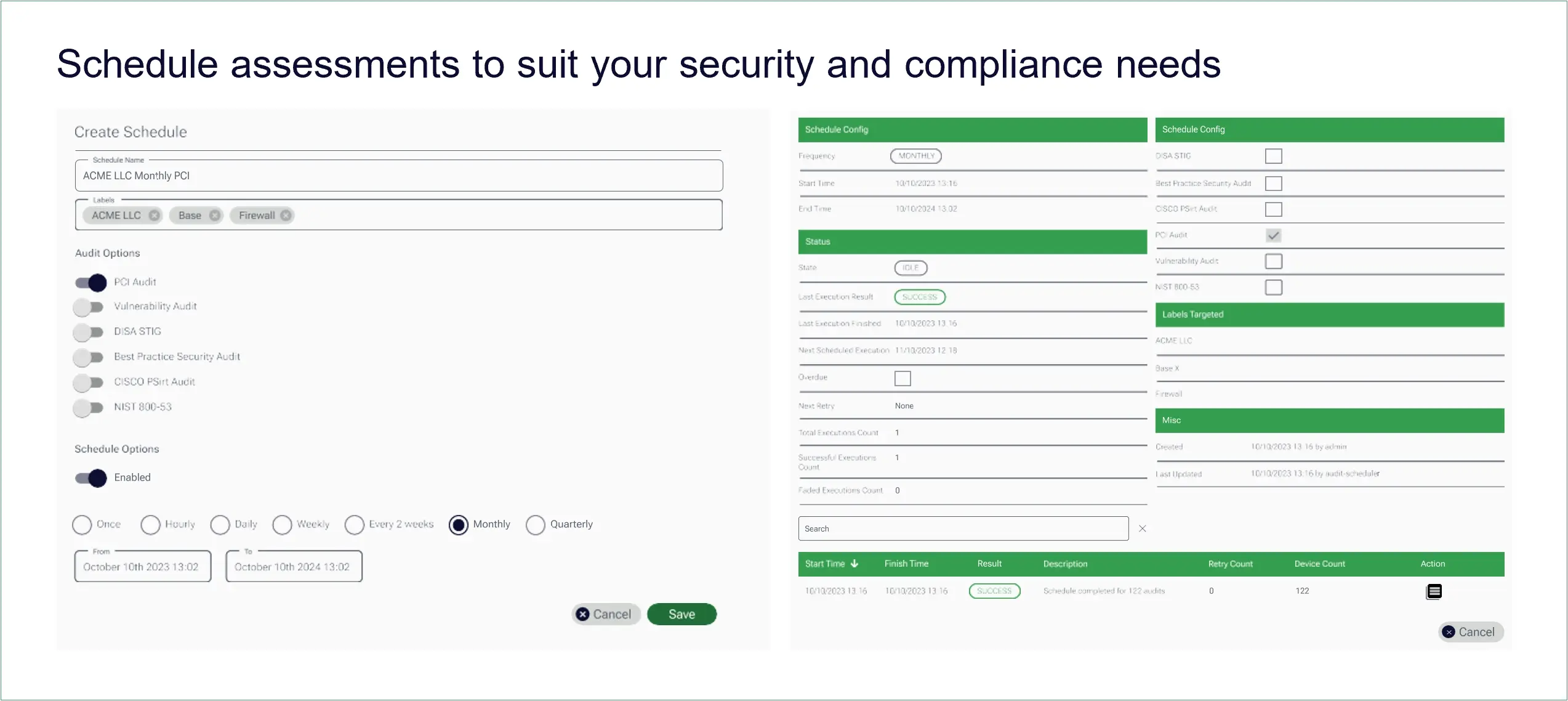

Schedule your PCI DSS assessment in Nipper Resilience, in three simple steps

When configurations are synced, PCI DSS assessments of the entire CDE network infrastructure can be scheduled in three simple steps:

-

Firstly, identify the segment you want to assess (e.g ACME Bank LLC -> United Kingdom -> London -> Project X -> CDE)

-

Secondly, choose which assessment to perform on that segment’s devices (e.g PCI DSS, NVD/PSIRT, Best Practice Security Audit)

-

Finally, set your cadence and control how frequently this assessment should be carried out throughout the year (e.g. quarterly to support PCI DSS evidence for audit, or daily to drive security from compliance).

Nipper Resilience then performs the assessments at the set cadence - on an up to hourly basis as required - and all the evidence is collected and consolidated, which can then be pushed to various platforms including SIEMs (e.g. Elastic or Splunk) and GRCs for visualization and/or further analysis.

Proactive assessment, effective incident response

Whilst automating the PCI DSS 4.0 requirement checks relevant for network devices in CDE segments is possible on a daily basis with Nipper Resilience, this generates a lot of repetitive data. So Nipper Resilience allows risk owners to apply logic to compliance assessments, and only assess configuration changes to networking devices, between monthly or quarterly audits, to determine whether the CDE has been exposed - either accidentally or nefariously.

Assessing devices after they have been altered can identify potential indicators of compromise; insight which can inform incident response teams to help shut-down threats in good time. Including threats that come from the inside, such as disgruntled employees or those seeking to expose valuable data for financial gain. For example, if an attacker focuses on non-repudiation by disabling audit logging to conceal their next phase of their attack, they are then free to manipulate firewall rules or create new interfaces to access the CDE segment. And oftentimes a bad actor starts the first phase, then waits to see how effective an organization’s incident response is before proceeding. Nipper Resilience’s proactive assessment approach stops this kind of attack in its tracks.

Nipper Resilience’s proactive assessment capability provides visibility of changes in the CMDB and applies a configurable set of rules, such as “as soon as a device in the CDE segment has changed, perform a PCI DSS 4.0 assessment.”

Deployed in this way, Nipper Resilience delivers continuous assessment of the CDE, in a highly practical way.

Risk-prioritized remediation that improves PCI DSS compliance posture

Many enterprise organizations are tasked with tens of thousands of networking vulnerabilities at any given time, thanks to out-of-date software. Patching every one simply isn’t practicable. And given that only around 8% of all software vulnerabilities have ever been exploited*, it isn’t necessary either. Which is why risk-based vulnerability management (RBVM) is increasingly the focus for risk owners.

Nipper Resilience takes RBVM to the next level with network exposure analysis, enabling network teams to overlay different risk lenses on their PCI DSS compliance posture. For example, overlaying Nipper Resilience’s MITRE ATT&CK analysis on the organization’s PCI DSS compliance posture highlights which non-compliant misconfigurations and software vulnerabilities are most likely to be targeted by active threats. Informing remediation workflows to address these risks first, would not only demonstrably improve PCI DSS compliance posture, it would drive better security from compliance.

*Source: Gartner, 2023, How To Implement a Risk-Based Vulnerability Management Methodology

Security beyond the CDE

Nipper Resilience helps risk and compliance owners to segment and lock down the CDE, but it is also a next-gen vulnerability and exposure management solution for securing the attack surface beyond the CDE. As well as enabling teams to increase the cadence and scale of accurate and detailed network assessments, the range of risk lenses in Nipper Resilience makes it easy to apply to assessment data, providing a transformative, proactive security solution that:

- Reduces the attack surface – minimizing the area open to potential threat

- Containerizes threats and prevents the proliferation of attacks, including ransomware

- Makes it easier to implement effective controls and reduce exposure to real world threats

- Neutralizes insider threat – which can be nefarious or accidental leading to external attack

- Supports full control of operational bandwidth

To discuss your PCI DSS use case, and which solution is the right size for your organization, get in touch to book a demo.