Resources

PCI DSS 4.0 compliance reporting made easy with Nipper solutions

A faster way to a secure and compliant Cardholder Data Environment (CDE)

Showing compliance with the Payment Card Industry Data Security Standard (PCI DSS) has typically involved manually mapping CDE network infrastructure device checks to requirements. A process which is inherently time-consuming and can be prone to error.

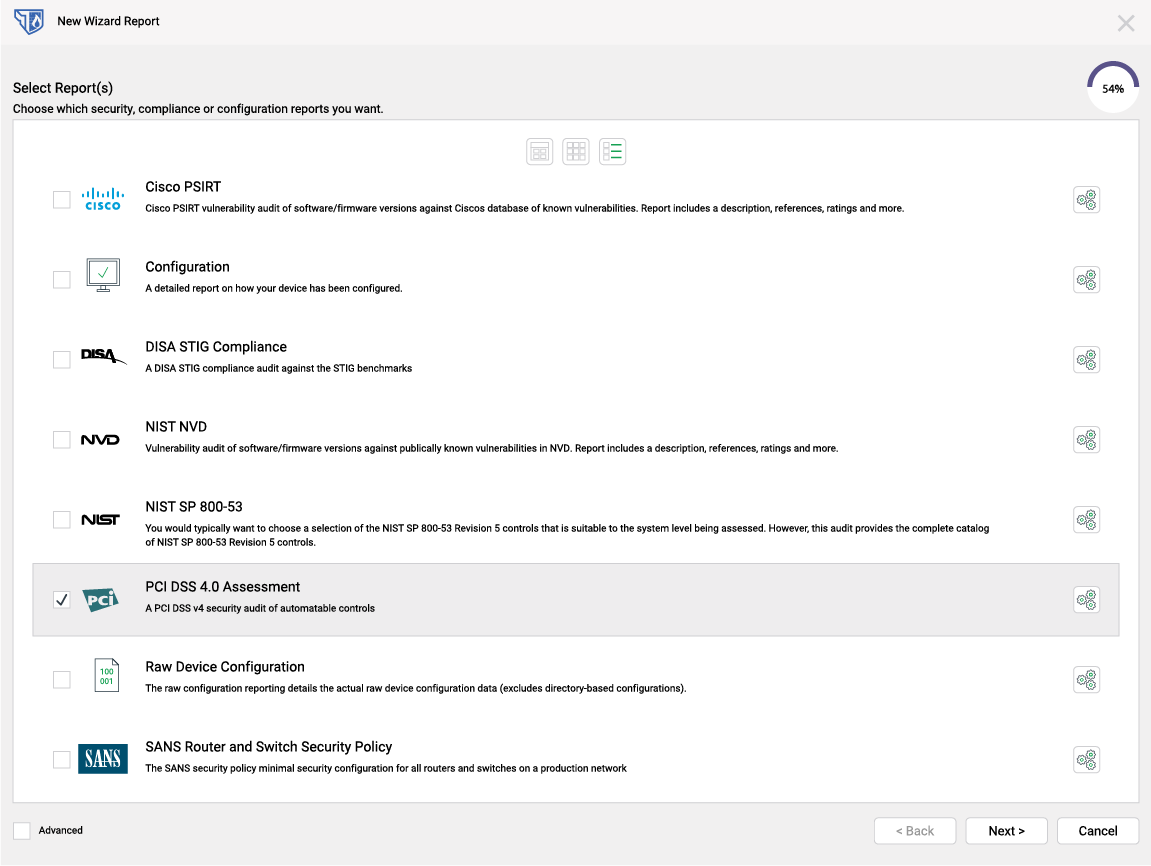

The latest versions of Nipper solutions deliver a new, dedicated PCI DSS 4.0 compliance report that changes all this. Allowing ISAs and QSAs to carry out PCI DSS 4.0 compliance assessments for every router, switch and firewall in the CDE - and beyond, it provides an automated way to:

- Assess network segmentation effectiveness

- Validate compliance with evidence

- Automate security as a continuous process

Commercial CNI organizations that are mandated to evaluate and report their compliance will benefit from:

- Automated requirements mapping of PCI DSS network device checks with drill down to testing procedures.

- An assessor-ready report providing evidence for both passed and failed checks and a risk-prioritized view of non-compliances.

- Device-specific guidance on how to fix misconfigurations - including command line scripts in some cases - to decrease mean time to remediate compliance risks.

Nipper solutions reveal the impact of non-compliances, calculating the risk to the network if the configuration is exploited, to drive risk-prioritized remediation.

Nipper

Nipper automatically analyzes any PCI DSS non-compliances it identifies, to reveal the impact to the device if the configuration is exploited, as well as the ease of exploit, and ease of fix, providing an informed view of the device’s risk posture to drive risk-prioritized remediation.

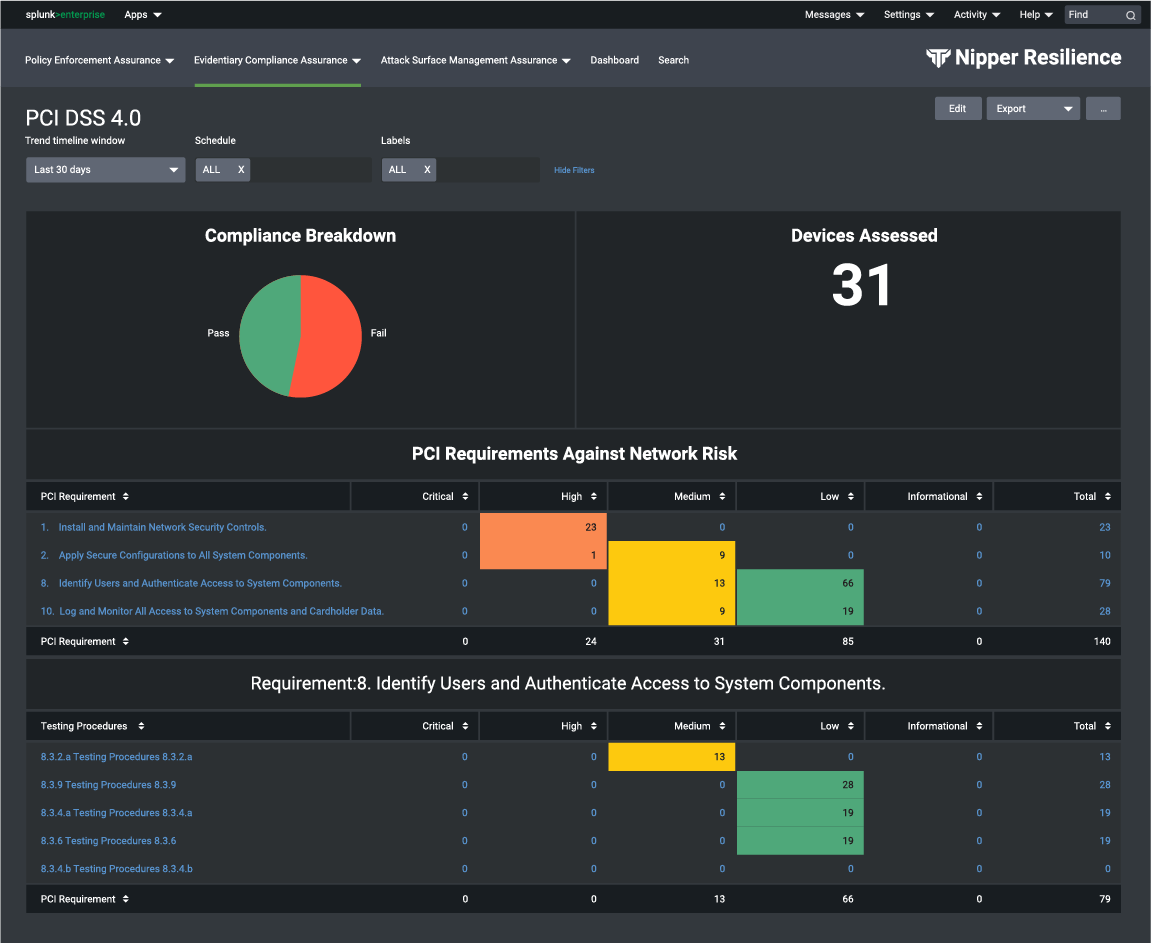

Nipper Resilience

To assure continuous PCI DSS compliance, Nipper Resilience leverages the precision of Nipper to assess every router, switch and firewall in the CDE, on an up to hourly basis, or whenever configuration changes are detected.

A Nipper users guide to the innovative PCI DSS Compliance Report features

Streamlining compliance reporting so you can focus on fortifying CDE security

Delivering so much more than accurate compliance reporting, Nipper’s PCI DSS 4.0 report is packed with powerful insights to help embed the risk focus, evidence and best practice required to deliver security from compliance. Here’s your guide to risk-prioritizing non-compliances for remediation, tracking changes between audits, and driving further investigation into whether drift was accidental or deliberate.

1. At-a-glance compliance posture

Innovation

Nipper checks are automatically mapped to PCI DSS 4.0 requirements. Drill down from the summary to the testing procedure to examine the results.

Benefit

Get a high-level overview of the PCI DSS assessment results, summarizing passes, fails, and any checks that are not applicable to the specific devices that have been assessed.

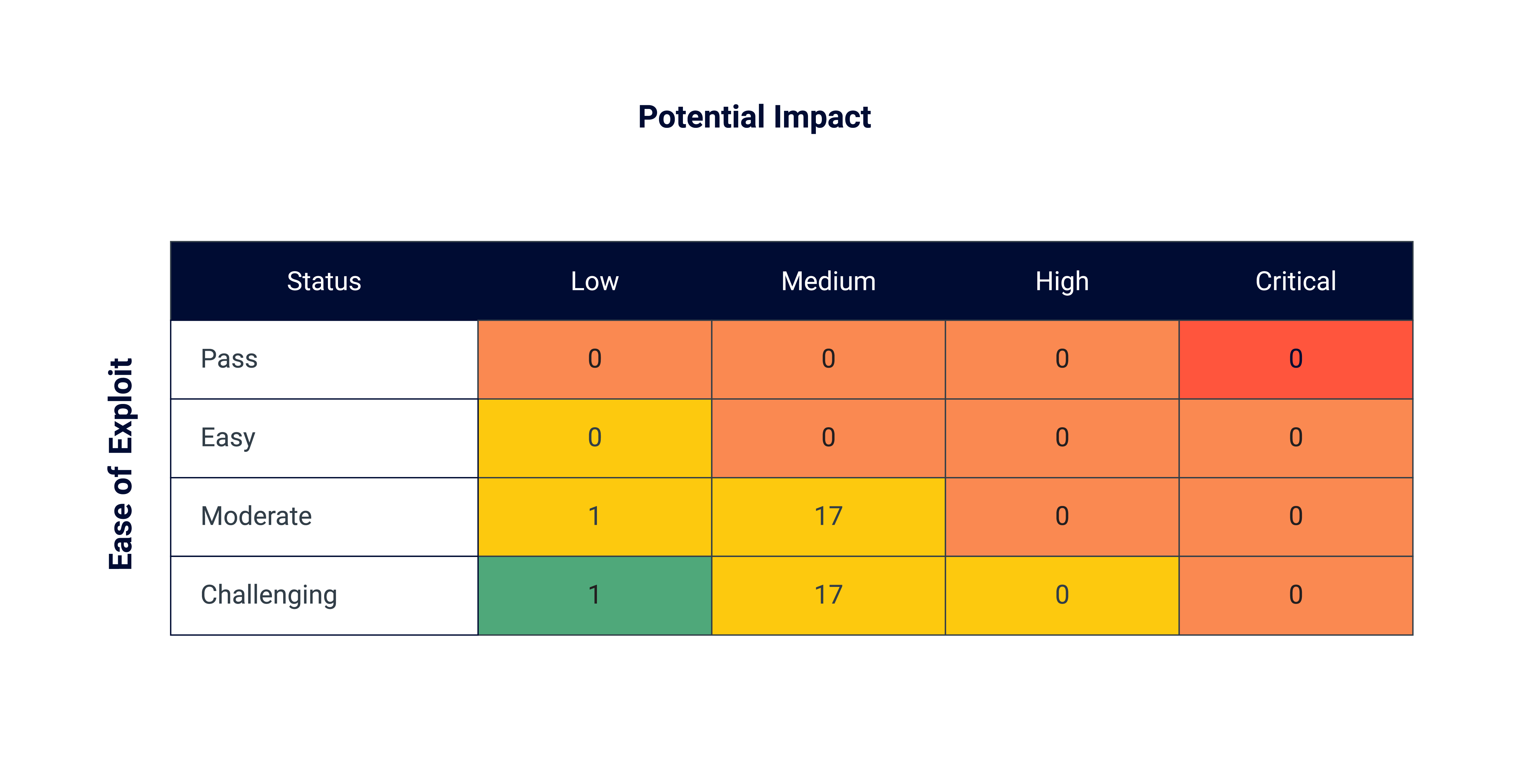

2. Potential impact summary

Innovation

Nipper automatically prioritizes findings based on ease of exploitation and impact to the network if exploited. Non-compliances are prioritized based on RAG status, reflecting risk criticality.

Benefit

Understand the potential impact of non-compliances with a color-coded display that ranks findings based on vulnerability risk and ease of exploitation.

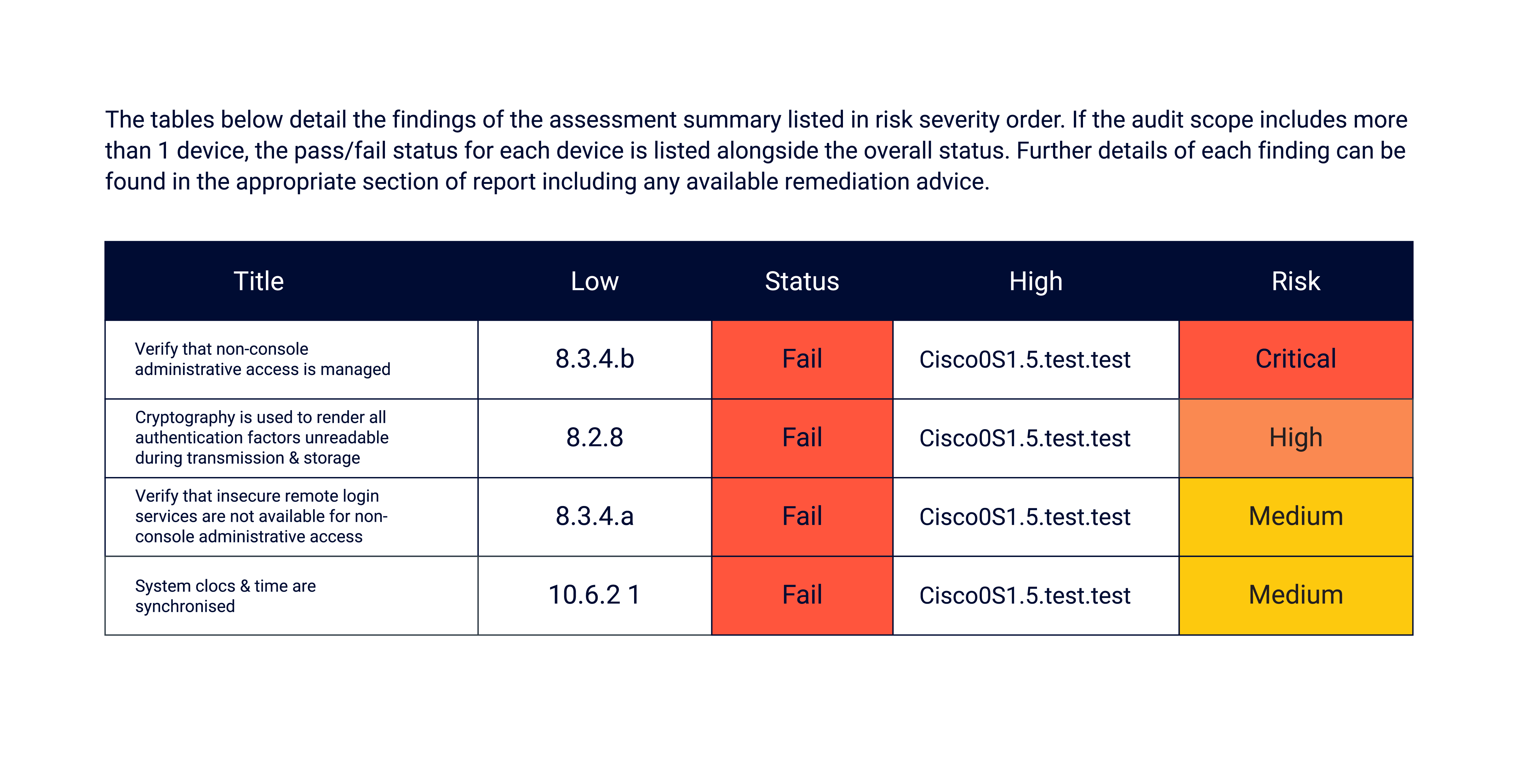

3. Risk-prioritized findings

Innovation

Nipper then lists the detail of each of the assessment findings (pass and fail). And identifies the specific devices affected that carry a non-compliance risk.

Benefit

Drill down to passes and failures prioritizing the most critical non-compliances first and identifying the devices that require remediating action.

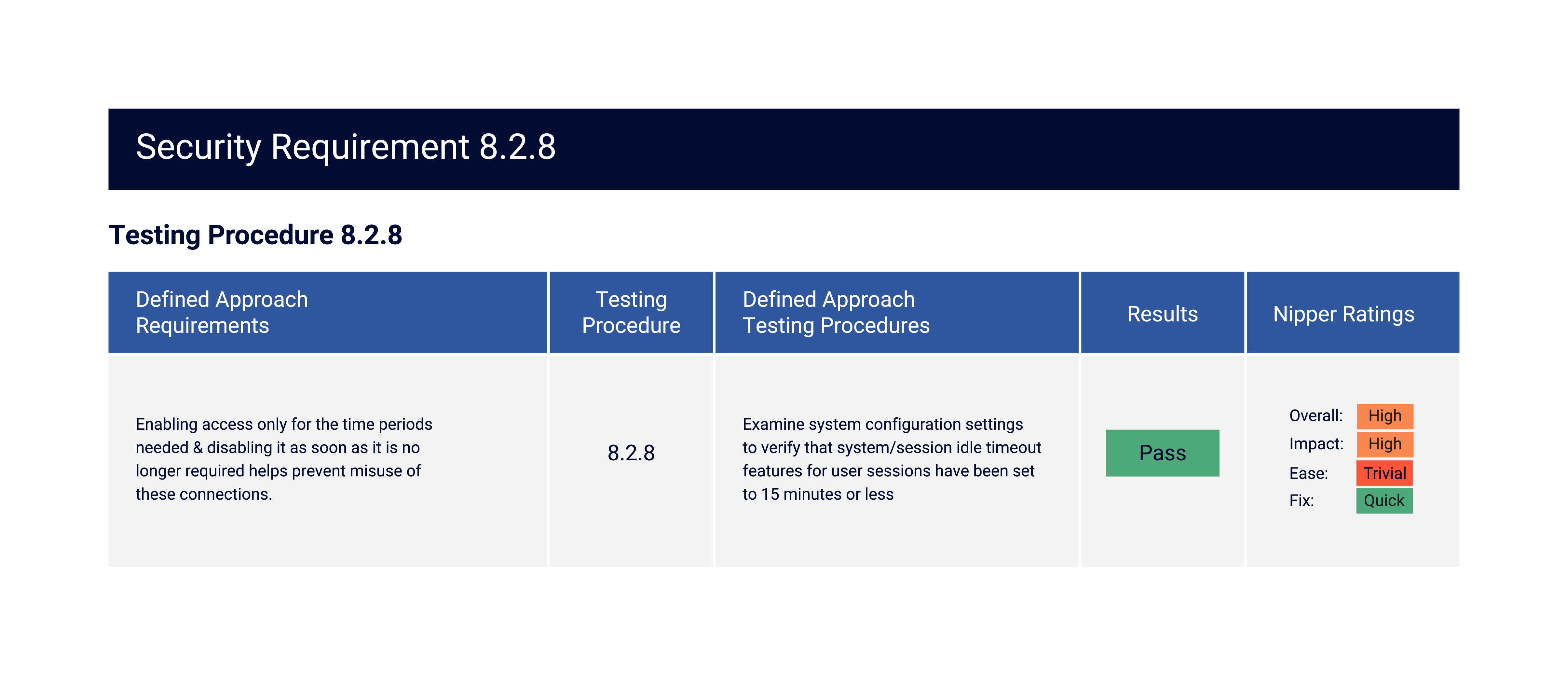

4. Evidence-based analysis

Innovation

Nipper’s risk analysis of each non-compliance harnesses networking know-how to determine the ease of exploit and potential impact to security. The ‘fix rating’ automatically provides an ‘ease of fix guide’ for each non-compliance found.

Benefit

For each device tested, view findings against applicable PCI DSS requirements, with an explanation of the testing procedure and Nipper’s detailed risk assessment to validate compliance posture.

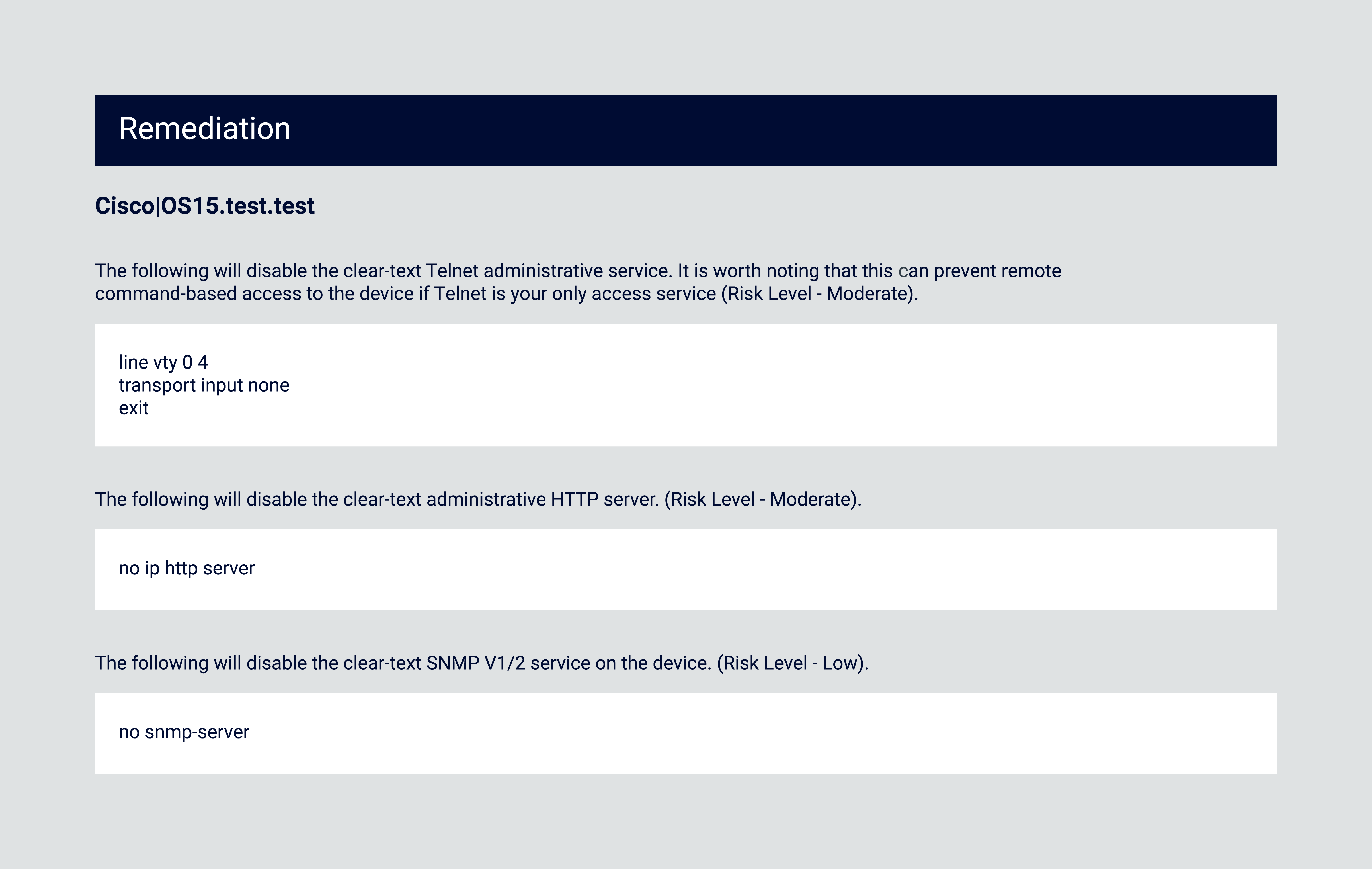

5. Remediation advice

Innovation

Nipper determines exactly how the configuration does not comply with PCI DSS 4.0 requirements, and how the risk can be mitigated. Command line instructions are provided, where possible, to reduce the mean time to remediate risks,

Benefit

Reduce mean time to remediate vulnerabilities with detailed advice on how to mitigate non-compliances and improve PCI DSS compliance posture.

From Compliance Assessments to Continuous PCI DSS Assurance

Whether you are an ISA or QSA looking to automate periodic PCI DSS 4.0 compliance assessments or an enterprise striving for continuous compliance assurance – Titania has a solution for you.

On-demand PCI DSS compliance

with Nipper

Auditors and external assessors choose Nipper to quickly verify configurations are secure and/or meet regulatory compliance standards, reducing their audit times by up to 80%.

PCI DSS Compliance assurance at scale

with Nipper Resilience

Deployed by SOCs to assure the security and compliance posture of network infrastructure, Nipper Resilience also adds a transformative proactive security layer to the NOC tech stack. Nipper Resilience integrates with SIEM, SOAR, ITSM and GRC solutions.

Talk to an expert

Request a demo to see for yourself how Nipper solutions will be of value to you.

.png)